Brutality Reality: College Costs

October 20, 2019

The cost of college is currently on a destructive path, bringing devastation to the bank accounts of millions of Americans. Unless you’re part of the top 1%, a gifted athlete, or an absolute genius, getting a terrific college education has become straight up unaffordable. As prices continue to skyrocket, more and more high school seniors are left baffled by how they can afford their college education. Here’s the scariest part: average yearly tuition costs between private and public universities have increased by 185.3% since 2000. More than likely, college costs will exceed $80,000 per year in the near future.

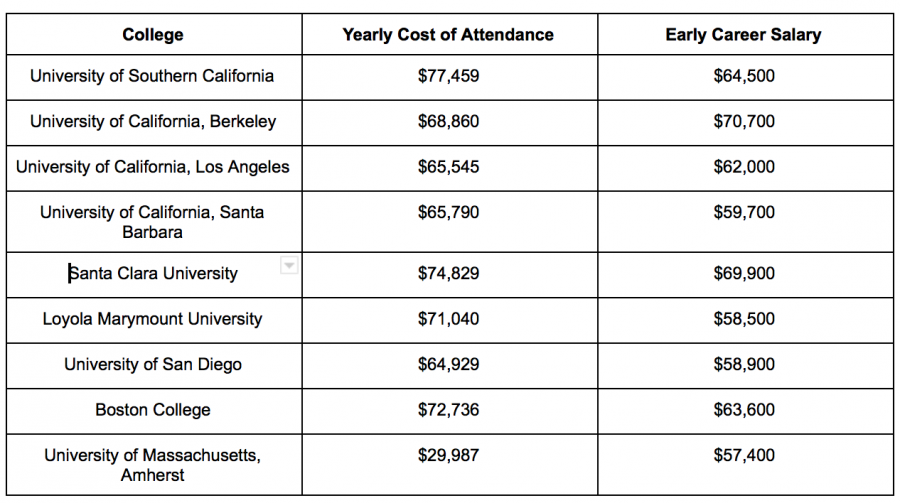

As a senior at SHS, I am currently pursuing my dream of attending college on the West Coast; therefore, seven of the nine colleges on my list are located in California. However, when I took a long, hard look at the numbers, I couldn’t believe what I saw: Yearly costs of attendance exceeded $60,000 for each California college on my list.

My #1 school is the University of Southern California (USC), which costs an estimated $77,459 to attend for the 2019-2020 school year. Tuition itself costs $57,256, with the remaining $20,203 paid in living expenses. That adds up to a staggering $309,836 estimation for a 4-year bachelor’s degree, and that doesn’t even take into account plane tickets or yearly tuition inflation. Realistically, the total amount I would owe by the time of graduation would be even more. Granted, admission to USC is highly competitive, so my chances of having to face these costs are dependent on my slim chance of acceptance. However, that does not take away from the disturbing reality that these egregious costs do exist, and more and more colleges are demanding them.

What about some more likely scenarios? Even for colleges that I have a better chance of getting into, I would face similarly steep costs to attend. Santa Clara University: $74,829, Loyola Marymount University: $71,040, University of San Diego: $64,929. Those add up to 4-year summations of $299,316 (SCU), $284,160 (LMU), and $259,716 (USD), once again barring out-of-state transportation and tuition rate inflation. It seems like no matter where I attend, my dream will result in me staring down a nasty price tag.

There must be options for costs like these to be lowered. On paper, the answer is yes, but most of those options are heavily flawed in their ways. Many people would point to the Nonresident Supplemental Tuition fee of $29,754 that students like myself would have to pay for out-of-state tuition. The fee can indeed be avoided by staying in-state for college, but there’s a catch: that approach only works for public universities. Private universities disregard your geographical situation as it relates to your cost of attendance; it would cost me roughly the same $72,736 per year to attend Boston College as it would for a non-Massachusetts resident. Going to a public college is not always the most enticing option either when looking for an excellent college education; 41 of the top 50 colleges were private, non-profit institutions in Forbes’ 2019 edition of America’s Top Colleges.

The most common option is financial aid, which is provided federally, direct from the college, or through a combination of the two. The problem with financial aid is that it allows for a short-term solution for a long-term issue. In the college graduating class of 2018, graduates who used any means of financial assistance were left with an average debt of $29,800. In an ideal scenario, these student loans are typically paid off within the first ten years post-graduation, but for many graduates, that debt exceeds the ten years. So what use does financial aid really serve to students if it ultimately buries them in debt?

The smartest way to decrease the cost of college is to explore scholarships, of which there are many different types available. Scholarships directly reward you for outstanding achievement in one aspect of your life or education. In 2018-2019, scholarships and grants covered 31% of average college costs for families, the most significant percentage among methods for lowering costs. So for students like myself, who are looking to soften the blow of college costs, scholarships are the way to go.

Colleges justify the cost of attendance by highlighting the average income of their students post-graduation. After all, the overarching goal of every university is to set up its students for success in the real world. Every college graduate should have an annual salary that exceeds the yearly costs associated with earning their degree. This is essential to pay off all college debt within ten years. Let’s put this factor into play through the context of my college list:

Only two of nine colleges on my list have costs of attendance less than the early career salary of their graduates: UC Berkeley and UMass Amherst. The fact that seven of these nine colleges currently do the opposite is the final straw leading me to this conclusion: Any college that charges more per year from students than subsequent early career salary expectations is not only providing a great disservice but quite plainly, not able to justify their price tag.